The Basics of Creating a Cloud-Based Trading Platform

A trading platform is a trader’s main tool for buying and selling assets in the financial market. Picking the right one is crucial to making the process safer, more convenient, simple, and successful. Today’s casual and active traders look for one-stop-shop solutions that would allow them to trade from any device and any place: home, office, car, and even beach. Especially during the ongoing pandemic. They want agile, effective software that doesn’t require cumbersome installation, take up a lot of hard drive space, and is resilient to sudden network problems. And cloud-based trading platforms meet all these requirements perfectly. They allow for 24/7, uninterrupted trading, securely store user data, provide instant access to trading information, and ensure seamless collaboration within a team for fintech companies.

In this article, we’ll cover the nuts and bolts of creating a cloud-based trading platform to help you build a robust solution that stands out in the market.

How to Choose a Cloud Service Provider

One of the key benefits of cloud-based solutions is that users don’t have to download and install them on their devices. That way, you can save precious hard drive space and computational power to make the application work. But it certainly doesn’t mean that such apps don’t need any storage space and computing power to run. Unlike on-premise solutions, cloud-based software does all the computing behind the scenes, in the cloud. That requires a cloud provider to host the application and provide users with access to it.

So the first thing you should do when creating a cloud-based trading platform is to pick a cloud service provider. There’s no one-size-fits-all solution. To make the right choice, you need to focus on your platform needs and project budget.

However, there are some essential things you may want to look for in a cloud provider. Let’s take a closer look at them.

Security. With on-premise hosting getting rapidly replaced by the cloud — 92% of organizations now host at least part of their IT environment in the cloud — security is becoming a major concern facing the industry. According to IDC, 98% of companies have experienced at least one cloud data breach in the past 18 months, which is 20% more than in 2020. That’s why your trading platform needs a cloud provider with the utmost protection.

First, determine your security goals based on the type of data your trading platform is going to process and store. Then explore the security measures offered by various providers and the mechanisms they use to protect client information and software. You may also want to clarify and define legally what each party — you and your cloud provider — is responsible for to avoid misunderstandings in the future.

Reliability and availability. Along with security, cloud availability and reliability are the most important criteria for selecting a cloud provider, not to mention these are probably the main two reasons to migrate your business to the cloud. So to build a reliable cloud-based trading platform and keep it up and running 24/7, you should consider providers that offer widespread available and uninterrupted hosting services. Examine the history of downtime of cloud providers you’re evaluating. Such information is usually freely available on the internet. For example, Amazon Web Services shows up-to-the-minute information about each service on six continents.

Architecture. When choosing a cloud provider for your trading platform, you need to think about how the cloud architecture you are planning to purchase will be incorporated into your current and future workflows. For example, if your company has already invested massively in the Google or Amazon services, it makes perfect sense for you to proceed with these vendors for easy integration and consolidation.

Scalability. When your user base starts growing, you might need to increase the number of IT resources consumed, or vice versa, if the demand for your service has fallen — downscale the platform to avoid paying for unnecessary resources. Therefore, you may want to look for cloud providers that offer on-demand scalability of the cloud infrastructure.

Compliance. Next, make sure that the cloud provider you choose can help you meet standards that apply to fintech companies: SOX, FINRA, SIPC, PCI DSS, SOC 1 & 2, etc. As with security, you need to understand where your responsibilities lie and what aspects of compliance the provider can help you handle.

Now, as we’ve covered how to choose a service provider when creating a cloud-based solution, let’s dive into the trading platform basic functionality.

Features to Implement When Creating a Cloud-Based Trading Platform

Some basic features of online trading software that all traders pay great attention to are:

Real-Time Quote Monitoring

In the world of online trading, every second counts. Therefore, real-time quote monitoring is an absolute must for any trading platform. This feature allows traders to track market movements — see asset prices go up and down — without the need to refresh the page.

Hotkeys

Hotkeys are a powerful tool that helps traders speed up the trading process, where shed seconds equal lost money. Whereas it takes a few clicks of a mouse and/or additional input to perform an action, traders can press a single keystroke or a combination of keystrokes instead while staying focused on their strategy. Hotkeys allow traders to enter orders, close open positions, cancel open orders, and more.

Charting

Charts are the key tool for comprehensive technical analysis of the financial market. Using them, traders can interpret price action and identify patterns to determine when to enter or exit a position. Basic charting includes different types of charts — bar, line, and candlestick — with basic technical indicators such as moving averages, stochastic, relative strength index (RSI), moving average convergence divergence (MACD), and Bollinger bands. More advanced trading platforms for seasoned traders provide a much wider range of studies and indicators and the ability to customize and configure indicators to trader needs.

News Feed

Since the financial market largely depends on economic, political, social, cultural, and many other events in a certain region or worldwide, most modern-day trading platforms come with newsfeeds. This feature keeps traders informed about the latest news in the trading industry to help them avoid mistakes and react to any sudden changes quickly. Using it, proactive traders can interpret the major factors affecting prices and take a position ahead of others.

Alerts

Customizable alerts are another essential feature of a solid trading platform. It allows traders to set up notifications about asset price changes, their stock position, major economic events, technical indicators, and more. That way, they can stay up to date with market movements without the need to spend hours monitoring charts on the screen.

Customization

Every trader has their own preferences to manage workflows and expects the platform to suit them. Therefore, today’s trading software provides users with the ability to customize layout, hotkeys, charts, time intervals, routing, and other features to their liking.

Mobile Access

Some platforms come with mobile applications, providing users with anyplace access to their accounts for convenient on-the-go trading. However, such apps are more like an additional feature that allows traders to walk away from their computers than a viable alternative to a full trading platform since they don’t provide the functionality you need for all trading activity.

Real-Time Support

Even the most reliable platforms are less frequently but still susceptible to occasional outages, network problems, and freezing of data that can affect trading significantly. If anything happens, traders must be able to get help immediately. However, phone or multi-day email support often outsourced to call centers, where reps read ready-to-use scripts, is a trader’s worst nightmare. A solid trading platform should provide 24/7 person support easily accessed directly through the platform.

How Softarex Can Help to Build a Trading Platform

We hope that the information in this article has given you a basic idea of what a trading platform should look like and what cloud aspects should be taken into account when building it.

If you consider creating a cloud-based trading platform to keep pace with the ever-changing customer demands and fintech trends, Softarex can help.

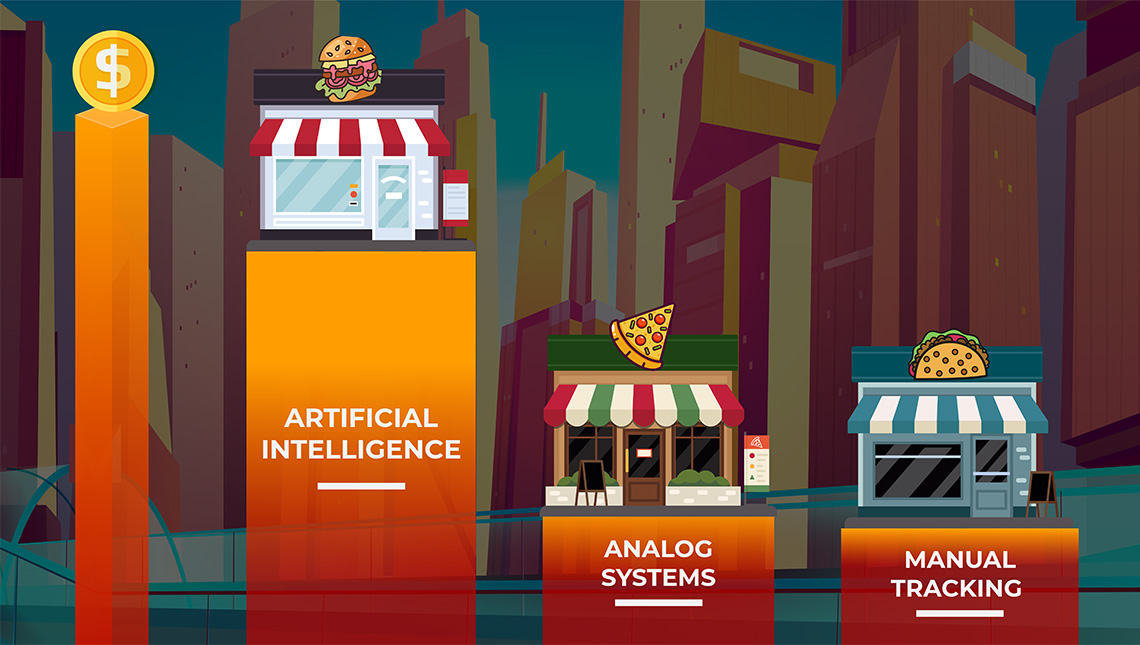

We leverage cloud computing, mobility, and AI to develop sophisticated software solutions that help financial organizations store user data securely, and deliver reliable online trading and banking services to their customers.

Drop us a line, and Softarex’s consultants will get in touch with you shortly to discuss your project needs.