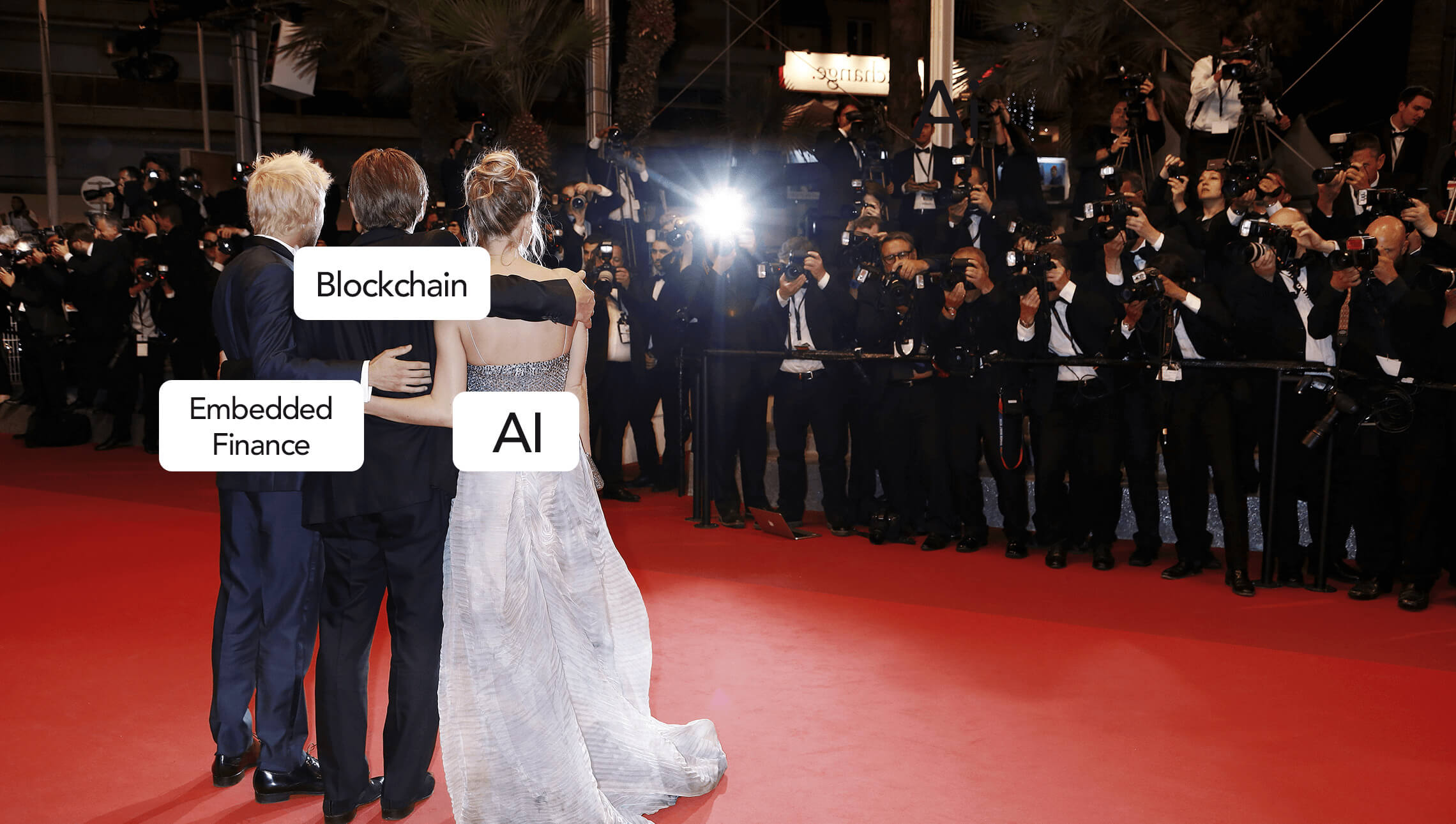

The Growing Popularity of Fintech Concepts

In today’s digital world, the only way for a business to survive is to adapt. Therefore, the latest technology trends are one of the major topics to keep up with for any company that plans to launch its own fintech project in 2022. In this article, we’ll discuss the hottest technologies and concepts that will be shaping the industry this year and beyond. Keep reading to learn what the future holds for fintech.

Artificial Intelligence

The global AI in fintech market is growing at lightning speed as businesses and financial institutions are increasingly adopting artificial intelligence and machine learning in their day-to-day operations. Its size is forecasted to reach $46.8 million by 2030 from $7.7 million in 2020. Let’s take a look at the fields AI and machine learning are going to have the greatest influence on in 2022 and in years to come.

Data Processing and Analytics

The amount of data being created, captured, copied and consumed is increasing astronomically. By 2025, it is projected to reach a new high of 180 zettabytes, almost doubling the 2020 volume of 64.2 zettabytes. The global data market is expanding accordingly. Its size is expected to grow to $103 billion by 2027.

For the finance industry, one of the world’s top contributors to this rapid growth, it means more investment in technology solutions for effective data processing and analysis. In 2022 and years ahead, we’ll see companies and financial institutions implementing AI and machine learning software to effectively decipher piles of customer information to make faster and smarter decisions every day. For example, when qualifying customers for credit services, pricing insurance and loans, detecting and preventing fraud, and providing more personalized experiences.

Customer Interactions

Just as in e-commerce, today’s customers expect fast, 24/7 service. To meet the need for round-the-clock interactions, fintech industry players rely on conversational AI. Virtual assistants and chatbots can solve customer queries, answer basic questions and communicate effectively with customers without human intervention. This is a great way for companies to not only automate customer support but also save money on hiring service agents and free up existing staff for more high-value tasks.

It is estimated that the use of chatbots will save the banking industry up to $7.3 billion in operational costs and 862 million hours (about half a million working years!) by 2023. So there’s every reason to believe conversational AI is here to stay. In the coming years, it will continue to impact customer-business interactions in financial services and make them more human-like with new advancements in artificial intelligence and machine learning.

Fraud Detection

With businesses embracing digital technology and customers living their lives online, the number of cybersecurity threats is skyrocketing. Compared to 2020, 2021 saw twice as many attacks per week on corporate networks, with the last quarter marking an all-time peak in weekly attacks per organization — more than 900 attacks per organization.

And although the finance industry is no longer the number one victim of cybercrime — for the first time in 5 years it has been dethroned by manufacturing — it still remains one of the most attractive targets for hackers due to the growing popularity of online transactions, mobile payments, and cryptocurrency.

Luckily, artificial intelligence can help companies protect their own and their customers’ data from cyberattacks. First of all by preventing fraud. AI tools continuously analyze customers’ transactional behavior and detect suspicious and fraudulent activities in real time so that they can be stopped immediately. More sophisticated cybersecurity solutions powered by big data and deep learning can detect malware, Trojans, and other threats before attackers start sending phishing emails to bank employees.

At Softarex, we believe AI will continue to be one of the hottest topics of discussion among businesses searching for new fintech project ideas, so you might want to keep up with it. We can’t wait to see what AI advancements 2022 will bring to cybersecurity in financial services and are always eager to partner up with businesses and financial institutions to develop smart and truly innovative fintech solutions.

Blockchain

Blockchain technology is getting extremely popular in the financial sector. This is currently one of the most investigated topics among fintech project owners. Companies and financial institutions are heavily investing in blockchain-based software solutions to make transactions and exchange information quickly and 100% securely, fight ever-increasing fraud incidents and track and manage assets. In the upcoming years, the market for blockchain software for the banking and finance sector will grow by leaps and bounds and rise to about $22.5 billion by 2026 from just $0.28 in 2018.

Behind that rapid growth, there’s VR and the Metaverse starting to penetrate our daily lives as Web3 is getting more accessible and safer. But perhaps the most important role in this process belongs to cryptocurrency. Today, more and more businesses, banks, and financial services companies are moving away from physical money. According to Deloitte’s 2021 Global Blockchain Survey, 76 percent of executives surveyed “believe digital assets will serve as a strong alternative to, or outright replacement for, fiat currencies in the next 5–10 years.”

In the near future, we’ll see a massive surge in demand for block-chain-as-a-service (BaaS) as more companies and organizations will be looking to take advantage of blockchain and crypto. By 2027, the BaaS market size will jump to $24.94 billion from $1.90 billion in 2019.

Embedded Finance

Embedded finance is yet another young trend picking up steam in the fintech industry today. Non-financial companies like retailers, manufacturers, taxi service providers, airlines, etc. integrate banking services such as payment processing and lending into their apps and platforms allowing customers to make purchases, pay for services, and even take out loans outside banks.

A key part of embedded finance is the “buy-now-pay-later” option. As the name suggests it allows users to buy goods and pay for them later, in smaller installments. On Black Friday 2021, the unofficial shopping holiday in the US, BNPL generated a 400% increase in the payment volume for PayPal from 2020 — around 750,000 transactions. It is already becoming mainstream. In 2022, 56% of Americans have used at least one BNPL service, which is almost twice as many as a year ago, and the number is going to grow.

By 2026, the global embedded finance market is expected to exceed $138 billion from $43 billion in 2021. So clearly this is only the dawning of embedded finance.

In Conclusion

These are the major technologies that will be shaping the industry in 2022 and beyond. Watch for them if you plan to develop a fintech solution in the near future or breathe fresh air into an existing one.

And if you need inspiration or expert tips for your next project, follow our blog for more articles on fintech and software development topics. Also! Don’t forget to subscribe to our newsletter, so you don’t miss any updates.

With over 20 years of experience, Softarex has the knowledge and best practices to share with the community. We are seasoned experts in data science, computer vision, and big data & analytics who develop software that facilitates the digital transformation of businesses across industries. Check out our portfolio to learn about our best projects. We are also always willing to collaborate, so feel free to contact us to discuss your development needs.